Stamp Duty Updates 2025: What Buyers & Property Investors in Kent Need to Know

From 1 April 2025, new Stamp Duty Land Tax (SDLT) rules will apply in England. These updates will affect first-time buyers, landlords, and property investors.

If you are considering buying in Kent, it is essential to understand how these changes will impact your finances. By planning ahead, you can still take advantage of strong market opportunities.

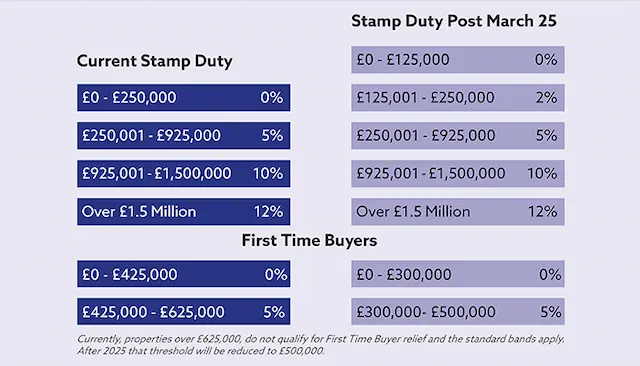

Key Stamp Duty Changes in 2025

The UK government has announced several important adjustments to Stamp Duty:

Standard Purchases: The nil-rate threshold will reduce from £250,000 to £125,000. As a result, more buyers will need to pay Stamp Duty on lower-value homes.

First-Time Buyers: Relief will now apply only up to £300,000, down from £425,000. In addition, the maximum property price eligible for relief will fall from £625,000 to £500,000.

Additional Property Surcharge: The surcharge for second homes and buy-to-let properties will increase from 3% to 5%, making portfolio expansion more expensive for landlords.

👉 For an official overview, you can check the UK Government’s Stamp Duty guidance.

What This Means for Property Investors

Opportunities in Kent’s Property Market

Despite higher taxes, Kent remains attractive. The county offers steady price growth, strong tenant demand, and new development projects, such as the 2,000 new homes in Canterbury.

In addition, Kent’s proximity to London and improving transport links mean properties remain appealing to both commuters and local renters.

Risks with the 5% Surcharge

The rise in surcharge from 3% to 5% means landlords will face higher upfront costs. Therefore, careful yield calculations are essential before committing to a purchase. For example, a £300,000 buy-to-let now attracts £15,000 in surcharge alone.

Attractive Rental Yields

On the positive side, Kent still offers net rental yields above 5.75% in many areas. This is higher than the UK average. As a result, landlords can offset some of the increased Stamp Duty costs with consistent rental income.

To help you plan your property strategy in 2025, explore these guides:

📖 Guaranteed Rent Explained: How Landlords Can Secure Income

📖 Download Landlord & Investor Resources on Stanstore – including guides on setting up a limited company, Airbnb hosting, and property management tools.

👉 By combining these resources, you’ll gain the knowledge and tools to make smarter investment decisions.

The 2025 Stamp Duty changes create challenges, but Kent is still a profitable place to invest. With strong rental yields and ongoing development, the region offers long-term value for landlords and investors.

📞 Book your Free Consultation today, and let Purifico Property Services guide you through the 2025 market changes.